The Need For Compliance

You probably know the IRS has adopted a new revenue recognition standard. All extensions previously granted by the IRS to comply with new accounting rules have now expired. As a result, all organizations must comply with the new standard by December 31st 2019. Has your accounting department ensured that your sales commissions are 100% compliant with IRS requirements? Sales Cookie can help you automate every aspect of your commissions – including ASC 606.

This article describes the whole process of delivering compliance for your sales commissions. We’ll show you how to generate accounting entries with proper amortization of sales commissions. Sales commissions represent on average 8% of all revenue, so lack of compliance can lead to major accounting problems. It could also prevent your organization from receiving new funding, require your earnings to be restated, or even result in steep fines.

The Road To Compliance

As per new accounting rules, you must correctly expense and amortize the cost of sales commissions. Amortization of sales commissions is not easy because it should be based on each deal’s duration. For example, if you sell some type of IT service, you may sell 1 year packages, 2 year packages, etc.

Typically, reps receive sales commissions on the basis of closing multiple deals. Often, each deal has a different duration. In the example below, a rep received a $1,200 commission for reaching his monthly quota. During this month, he was credited with 2 deals, each with a different amount and duration.

Step 1 – Capitalizing Costs

First, you must capitalize the cost of sales commissions. Assets which help generate income in the long-term are capital assets. The ASC 606 standard explains how costs related to obtaining a customer contract should be capitalized. From an accounting perspective, each sale (ex: invoice, deal, opportunity) is a contract. Therefore, most sales commissions qualify for capitalization because they are related to contracts.

To generate an ASC 606 report, our commission automation solution starts by asking you to choose which commission payouts to take into account. For example, you could decide to take into account all 2019 commission payouts. You also have the option to group payouts by date. For example, if Joe was paid some commissions on 2019-12-28, and some on 2019-12-31, you could decide to treat both payouts as “December payouts”.

Step 2 – Identifying Contract Durations

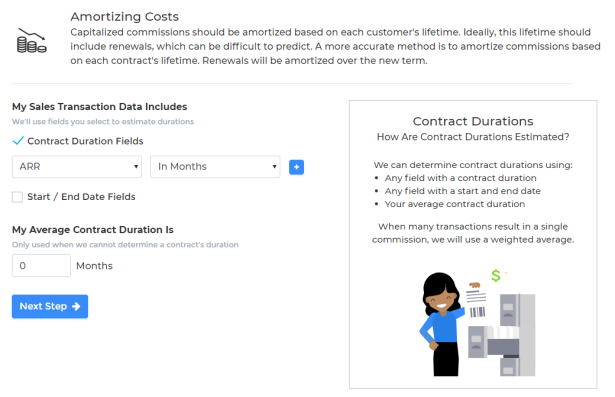

Ideally, capitalized commissions should be amortized over the duration of your relationship with each customer. This lifetime should include potential renewals, which are often impossible to predict. A more accurate method is to amortize commissions based on each contract’s lifetime. Any renewal will be amortized over its new term.

When generating an ASC 606 report, our commission automation solution asks you how you want to compute each contract’s duration. In the example below, the specified average contract duration is zero. However, some CRM opportunity records have a field called “ARR” which specifies the contract’s duration (in months).

Perhaps your sales data has fields which specify the contract’s duration (in days, months, or years). Or, perhaps, your sales data has fields with start and end dates. In any case, we can handle both scenarios. You can even specify multiple fields (this is useful if your sales data comes from different sources, each with its own fields).

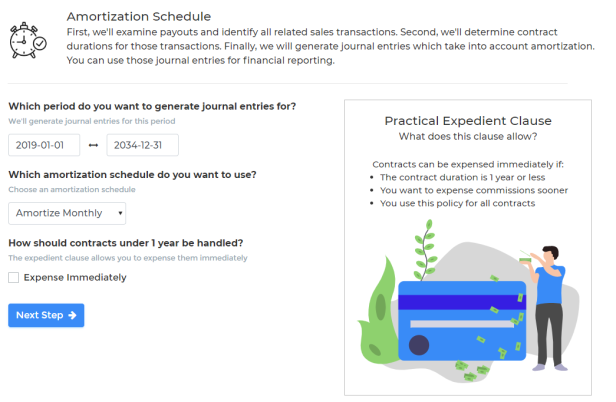

Step 3 – Choosing An Amortization Schedule

Next, you must choose an amortization schedule. For example, you could decide that you’d like to generate the amortization schedule for the next 15 years. Or you could decide that you just want to generate the amortization schedule for the current year. You can also choose an amortization frequency (ex: amortize monthly, quarterly, etc.).

For contracts whose duration is 1 year or less, the “practical expedient clause” allows you to expense commissions immediately. If you decide to use this option, make sure that it is used consistently by your accounting department. You cannot use this option if some customer contracts aren’t treated the same way.

Step 4 – Generate Amortization Entries

Generate amortization entries is a complex process but we’ll walk you through everything. We recommend using an automated solution with ASC 606 reporting to improve accuracy and avoid painful manual work. If you pay commission on each deal, ASC 606 amortization is reasonably simple, although you may have a lot of data to process. Now, if you have payouts which are associated with multiple sales (ex: a cash bonus for attainment), ASC 606 amortization becomes more complex. We’ll describe how you can deal with this situation.

Start by identifying each commission payout and all associated sales transactions which led to it:

- For each commission payout

- Identify its payment date

- Identify transactions (ex: invoices, deals, etc.) which led to this payout

- Identify each transaction’s contract duration

- Group those transactions by contract duration

- Determine the credited total for each group

- Assign a portion of the payout to each group (pro-rating)

- Example for one payout:

- Identify its payment date

- On 2019-01-01, a $1,200 commission was paid to “John Doe”

- Identify transactions (ex: invoices, deals, etc.) which led to this payout

- A total of 4 sales transactions led to this payout (#1, #2, #3, #4)

- Identify each transaction’s contract duration

- Transaction #1 = 1 year contract worth $15,000

- Transaction #2 = 2 year contract worth $25,000

- Transaction #3 = 2 year contract worth $25,000

- Transaction #4 = 1 year contract worth $10,000

- Group those transactions by contract duration

- Group A = 1 year duration

- Transactions #1 and #4

- Credited total revenue = $25K

- Group B = 2 year duration

- Transactions #2 and #3

- Credited total revenue = $50K

- Group A = 1 year duration

- Assign a portion of the payout to each group (pro-rating)

- Group A gets a third of $1,200 = $400 commission

- Group B gets two third of $1,200 = $800 commission

- Identify its payment date

Next, expand each group over time, starting from the commission payment date, based on the group’s contract duration and amortization schedule. For example, suppose that we have decided to amortize monthly, here is how we would create amortization entries from each group:

- Group A

- 1 year duration

- Commission payment date: 01/01/2019

- Pro-rated commission amount: $400

- This is 1/3rd of $1200 in commissions

- Because revenue for 1 year contracts represented 1/3rd of $75K in revenue

- Amortization schedule

- Jan 2019: 1/12th of $400 <- amortize over 12 months

- Feb 2019: 1/12th of $400

- March 2019: 1/12th of $400

- Etc.

- Group B

- 2 year duration

- Commission payment date: 01/01/2019

- Pro-rated commission amount: $800

- This is 2/3rd of $1200 in commissions

- Because revenue of 2 year contracts represented 2/3rd of $75K in revenue

- Amortization schedule

- Jan 2019: 1/24th of $800 <- amortize over 24 months

- Feb 2019: 1/24th of $800

- March 2019: 1/24th of $800

- Etc.

Once you’ve generated amortization entries for all commission payouts, you can choose to keep them “as is” (in which case you have detailed amortization entries), or you can consolidate them (ex: grouping amortization amounts by quarter). We generate both detailed and consolidated amortization entries:

Our automated solution will generate a chart so you can visualize amortization over time:

We’ll even generate a chart showing the distribution of contract durations for sales transactions which led to commission payouts:

Step 4 – Entering Journal Entries

Finally! It’s time to convert your amortized entries into accounting journal entries. Here is a visual explanation showing how to input journal entries. As you can see, each amount is reported as a debit to an amortization expense account, and as a credit to an accumulated amortization amount. This keeps things in balance from an accounting perspective.

Here is some additional information you might find useful. To ensure compliance, the cost of commissions must be amortized over time. However, you typically pay for commissions immediately. This represents an EBITDA “add back” because the amortization of the commission’s expense is added back to EBITDA. This measure can improve earnings, but your Finance team will need to carefully track this.

In Conclusion

Special handling of sales commissions is required to comply with ASC 606 accounting rules. In this article, we described a detailed process to amortize sales commissions over time. To start automating your entire sales incentive program and ensure compliance, visit us online! We’d love to help.