If you’re looking for help designing a sales commissions structure, don’t look any further. You’ve found the ultimate commission design guide! At Sales Cookie, we successfully automate 99% of commission structures. We understand commission structure DNA, their permutations, and associated tradeoffs.

Using this online guide, you should be able to understand commission structures in depth and design a successful commission program. Designing a working sales incentive program is all about breaking commissions into components and making key choices along the way. We’ll guide you through this process. And we’ll explain the pros and cons of each approach.

High-Level Analysis

It’s always a good idea and step back for a moment:

- Who is responsible for calculating commissions?

- Unless you automate the process, calculating commissions is going to be repetitive and painful. It’s also a key responsibility. Who should own this painful, yet important process? Should it be your Finance department, your accountant, your VP of sales? Do you have buy-in from them? Will they have the stamina & discipline required to run this process (forever)?

- How long should it take to calculate commissions?

- If your commission process takes days, you will likely experience calculation errors, delayed payouts, and complaints from reps. Start by defining the maximum time it should take to calculate and audit commissions. This will force you to simplify your commission structure before it becomes too complex.

- How accurate do your commissions need to be?

- Should all commissions be calculated based on measurable goals and rep performance? Or should some commissions be more discretionary? Are manual adjustments forbidden, or are they expected? Is your data accurate and complete enough to ensure precise or automated calculations?

- Who are your payees?

- First, identify all roles eligible for commissions. Then, step back and determine corresponding key performance goals and behaviors you want to promote. Is it completing more product demos? Is it renewing customer contracts? You can’t define a commission structure without identifying each role and a corresponding set of sales behaviors to promote.

- Are your commissions competitive?

- To attract and retain top talent, you must do some research and make sure your incentive program is competitive. Consider working with your HR department to define a budget and to define a clear on-target commission variable for each role.

- What is your system of record for commissions?

- In most cases, it will be a/ your CRM system (ex: SalesForce), or b/ your accounting system (ex: QuickBooks). Here are their pros and cons of using each type of system for commissions:

- CRM systems always specify which rep or territory should be credited for each sale (ex: there’s always an opportunity owner). However, CRM systems don’t know if you actually got paid, when you got paid, and how much you got paid by your customers.

- Accounting systems always specify when each payment was received and its exact amount. However, they often don’t know which rep or territory should be credited for each sale (ex: do you have rep names on each invoice?).

- In most cases, it will be a/ your CRM system (ex: SalesForce), or b/ your accounting system (ex: QuickBooks). Here are their pros and cons of using each type of system for commissions:

- Do you have all the data required to calculate commissions?

- Let’s say you had to calculate commissions manually. Would you be able to do so based on all your current CRM or Accounting data? If not, first improve your current tracking of sales data until you can. If you can’t calculate your own commissions manually, nobody can. Not even automated commission software.

Think Commission Components!

To structure your commission program, start with the following:

- First, identify all sales roles

- Ex: Account Manager, Territory Manager, Service Engineer, VP of Sales, etc.

- For each role, identify 1-3 key goals

- Ex: increase revenue, book more appointments, sell upgrades

- For each key goal, identify 1-3 commission components

- Ex: monthly commission, quarterly bonus, upgrade commission plan

If you end up with more than 3 components for any given role, you got it wrong. Few individuals can optimize their sales behavior across 4+ dimensions. Having too many concurrent priorities is confusing.

Next, let’s define each component in more detail.

What Is Your Component’s Name?

Assign a name to each commission component, such as:

- “AE – Own Revenue – Quarterly Bonus”

- “AMs – Territory Revenue – Monthly Commissions”

- “BDR – Booked Appointments – Monthly Commissions”

Consider using [Role] + [Goal] + [Period] to name each component as shown above. This will ensure the following questions are answered:

- Who is this component for?

- Ex: it’s for BDRs

- What is the payment frequency?

- Ex: it’s monthly

- What is the goal?

- Ex: book more appointments

How Do You Set Sales Performance Targets?

Next, choose a way to set performance targets. Here are some typical strategies you can use to set goals:

- Count-Based

- Ex: the goal is a total number of booked appointments

- Here, a count determines commissions

- Point-Based

- Ex: the goal is a target number of hardware sale “points”

- This is useful if some sales activities are more valuable than others

- Quota-Based

- Ex: the goal is a quarterly revenue quota

- Relative attainment (ex: 120% of quota) determines commissions

- Fixed Thresholds

- Ex: the goal is 100K in total monthly revenue

- Absolute threshold attainment determines commissions

- Flat Rates

- Ex: reps get 3 to 6% percent of each sale depending on product categories

- In this case, there isn’t a specific goal to deliver on other than “sell more”

More exotic strategies are possible (ex: sales contests, growth-based goals, management by objective, etc.). However, avoid those when defining primary commission components. Once you have a well-working commission structure, you can add more twists such as spiffs, prizes, contests, etc.

Do You Have Attainment Tiers & How Do They Work?

You may choose to use attainment tiers. The goal is to:

- Punish underperformance

- Ex: under 50% of quota, no commissions will be paid

- Promote overperformance

- Ex: above 110% of quota, a commission accelerator will be paid

On the surface, tiers look simple. Many of our customers assume tiers can only be structured one way. However, there is some subtle but important complexity around tiers.

Let’s say you defined the following tiers:

- For revenue from 0K to 20K, pay 5%

- For revenue from 20K to 50K, pay 6%

- For revenue above 50K, pay 8%

This looks obvious, right? Well, it isn’t.

Tiers – Cumulative vs. Non-Cumulative Tiers

Assume a rep delivered 60K in revenue. If your tiers are non-cumulative, only the highest attained tier matters. The payout will then be 8% of total revenue (60K).

If your tiers are cumulative however, each tier pays a portion of revenue within its own band, so the total payout will be lower. Using cumulative tiers and for the same 60K total, the payout will be:

- 5% of 20K PLUS <- the portion of 60K revenue from 0K to 20K

- 6% of 30K PLUS <- the portion of 60K revenue from 20K to 50K

- 8% of 10K <- the portion of 60K revenue above 50K

Make sure to set expectations and explain to your reps precisely how your tiers work. Otherwise, they may assume they are non-cumulative and be disappointed once they review their commission payout and discover that they were cumulative.

Tiers – Per-Transaction vs. Portion-Based Commissions

Here we assume that you use cumulative tiers. As reps sell more during a given period, some sales will help them transition from lower attainment tiers to higher attainment tiers. So, how should sales which “sit on the fence” between two tiers be handled? You could:

- Apply the lower tier’s rate to the sale’s entire amount

- Apply the higher tier’s rate to the sale’s entire amount

- Split the entire sale’s amount into two portions

- And apply each tier’s rate to each portion

For example, let’s say you closed a single mega-sale worth 25K. This mega-sale lets you advance from tier 1 (revenue from 0K to 20K) to tier 2 (revenue from 20K to 50K). Should:

- This sale’s entire 25K be paid at the 5% rate (0K – 20K tier)?

- This sale’s entire 25K be paid at the 6% rate (20K – 50K tier)?

- This sale’s 25K amount be split into two?

- A 20K portion to be paid at the 5% rate (0 – 20K tier)

- A 5K portion to be paid at the 6% rate (20K – 50K tier)

To understand the pros and cons of each approach, read this article.

Tiers – Avoid Too Many Tiers

Defining too many tiers can make your reps feel like:

- Your commission structure is overly complex

- You are trying to nickel-and-dime on commissions

- Your sales objectives are artificial and fragmented

Suppose that you’re a rep, and that there are 10 different tiers. As you move up the attainment ladder, you know that the incremental benefit of advancing to the next tier is going to be quite small. That’s not very motivating, and it’s also confusing.

Do You Split Commissions?

Whenever more than 1 payee receives commissions from a single sale, you have a split. This can be an “obvious” split between 2 reps who worked together on a deal (ex: a BDR plus an Account Executive). Or it can be more subtle split – ex: your VP of sales also gets an override commission on all deals. In any case, it’s important that you identify those splits when defining your commission structure, especially in terms of financial impact and overall cost of commissions.

Should Some Reps Be Guaranteed A Commission?

Guarantees are common for reps who’ve recently joined a sales organization but haven’t had time to build their customer base. You can choose to temporarily “pad” their commissions using either:

- Non-recoverable draws – ex: they will receive a minimum $2000 commission each month for the first 3 months on the job. This guaranteed amount is forgiven and never has to be repaid.

- Recoverable draws – ex: they will receive a minimum $2000 commission each month for the first 3 months on the job. This is advance money which must be repaid over time

Recoverable draws can be quite complex because you also must also define a repayment schedule. For example, should commission advances be repaid as quickly as possible, or over a longer period?

Do You Withhold Commissions Until You Get Paid?

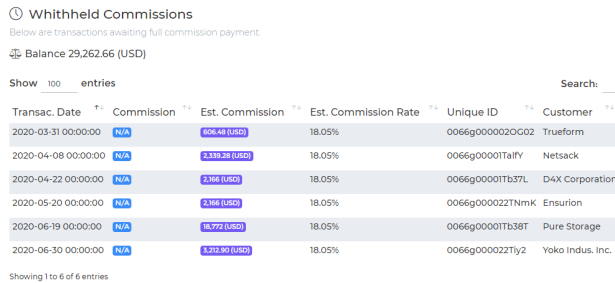

Some companies announce commissions early (ex: when deals close), but delay payment of commissions until payment is received from customers. For example, they want to tell their reps that they earned $5,000 in January based on closed deals, but that commissions will be paid later when payment is collected (which could be later in January, February, March, etc. – or possibly never).

This earned vs. paid dual approach to commissions is more complex as you have two event timelines to deal with (a closed timeline vs. a paid timeline):

- Declaring commissions as “earned” makes you liable to pay them in some jurisdictions – even if you did not collect payment

- The two timelines (earned vs. paid) makes it harder to provide reps with clear monthly commission statements they understand

- It can be challenging to track staggered payments, correlate each payment to past earned commission statements, and retroactively update rep statements

With an automated solution, this dual approach is possible, but keep in mind the tradeoffs and additional complexity. Often, you’re better off either:

- Paying commissions upfront (while penalizing future commissions when payment does not come through)

- Declaring AND paying commissions when you get paid

Which Sales Are Eligible?

To calculate commissions correctly, you must define which sales are eligible for your commission component. For example, you could choose to exclude taxes and shipping from revenue eligible for commissions. Or you could exclude certain products as non-commissionable.

Finally, you have to choose whether reps will be credited based on their own sales (ex: they own the opportunity) or based on a team or territory (ex: the ZIP code is within the sales territory they own, or the component is for a sales VP). This will determine whether your plan is based on individual results vs. team results.

What Is Each Sale’s Effective Date?

To calculate commissions correctly, you must define a commission effective date for each sale. For example, when calculating commissions for January, which sales are eligible? Those whose payment date was in January? Or those whose closed date was in January?

The effective commission date may vary depending on the role. For example, BDRs may be paid commissions based on when they created opportunities, while AEs may be paid commissions based on when they closed opportunities.

In all cases, make sure your chosen effective date cannot change. For example, if someone can edit opportunities in your CRM system, and keeps updating the close date, you may be fooled into paying commissions for the same sale multiple times. One time in January, then again in February, etc. Commission software like Sales Cookie will detect those situations and alert you.

How Should Returns / Cancellations / Refunds Be Handled?

It seems a bit unfair to allow reps to keep commissions for sales which later result in a refund or cancellation. The easiest way to deal with refunds is to apply a negative revenue amount to the period during which the refund occurred.

Suppose that, in January, a rep received a commission for a $1000 sale. In February, this $1000 sale was refunded. Simply apply a negative -$1000 to the rep’s February total revenue. This will reduce commissions accordingly and is equitable. This approach also lets you penalize rep attainment for the cancellation period.

Some organizations prefer to identify the original commission amount associated with the refund (ex: $10 was paid for the original $1000 sale) which is a clawback. However, this can increase complexity and generate more administrative overhead. And, sometimes, there isn’t a clear commission amount associated with each sale (ex: because your commission structure uses tiers or because you pay bonuses). As explained above, an easier approach is often to apply a -$1000 in revenue to the period of the refund, which is also better for tracking.

Do You Have Recurring Sales / How Do You Track Them?

If you have recurring sales, do you pay commissions upfront? Or do you pay commissions incrementally each time you receive a recurring payment from your customers? If so, the most important question is – how you represent recurring payments within your sales data?

If you use an Accounting system such as QuickBooks, you likely have separate record tracking each payment’s exact amount and date. However, if you’re using a CRM system such as SalesForce, you may only have a single opportunity, with an expected payment frequency and start date.

In this case, consider adding a cancellation / end date to your CRM records, so you can stop payment of recurring commissions if a customer cancels or stops paying. Also, you will likely need to automate because sifting through deals to determine which ones should yield a commission each pay period will quickly become tedious.

Is Your Commission Structure Compliant?

As per accounting regulations (ASC 606), if commissions are paid for deals whose associated delivery of service exceeds 1 year, you must amortize the cost of commissions over the contract’s duration. Make sure your finance team has all the data they need to correctly capitalize and expense commissions.

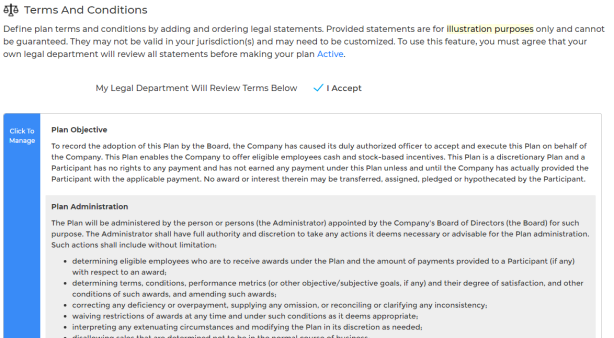

Also, to minimize legal risk, your commissions should be legally protected. This means providing a clear description of incentives to your sales team, and getting them to agree to terms and conditions (ex: e-signature). Also make sure to take into account edge scenarios such as employee termination, FMLA leave, sales interns, update to quotas, etc.

In Conclusion

That’s it! In this blog post, we describe a process to determine stakeholders, identify components, improve accuracy, and ensure compliance with standards. Using Sales Cookie, you can automate every aspect of your incentive program – tiers, splits, clawbacks, compliance, territories, and much, much more. Visit us online to learn more.