Here at Sales Cookie, we automate sales commissions for organizations of all sizes. Every day, we receive many requests for automation. In a perfect world, we’d help every client automate their commissions and eliminate manual spreadsheets. Unfortunately, sometimes automation sometimes isn’t the problem nor the solution. Some commission structures aren’t automatable because of the following:

- Commission rules are too complex relative to the number of payees

- Commission rules require manual decisions which are incompatible with automation

Commission Complexity vs. Number of Payees

The following “ingredients”, while complex, are also standard constructs in the unique world of sales commissions:

- Attainment tiers

- Cumulative payouts

- Non-cumulative payouts

- Recoverable draws

- Quotas and attainment

- Claw-backs / charge-backs

- Delayed / partial payments

- Triggered payment of commissions

- Etc.

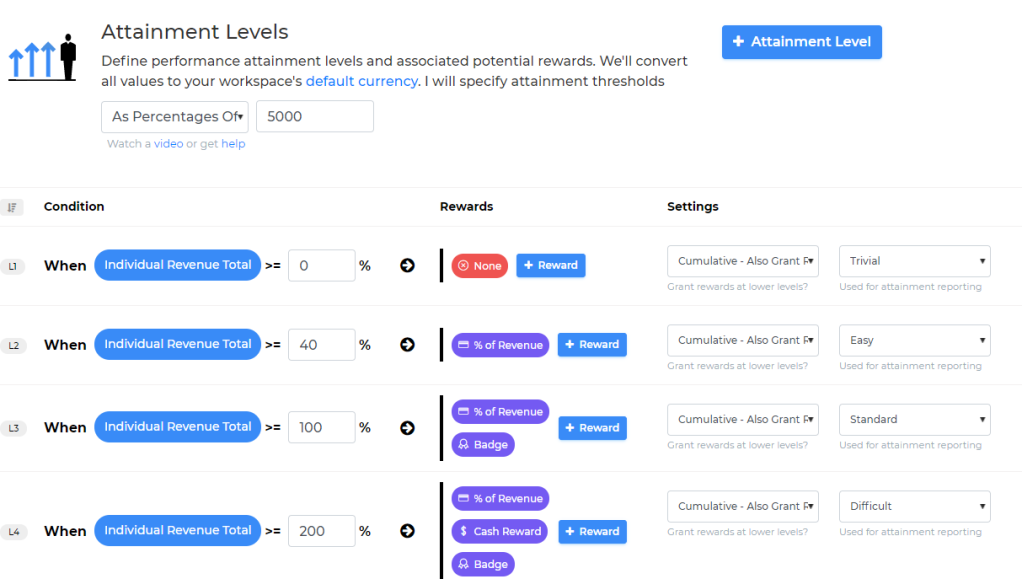

Because these are standard constructs, they are a breeze to automate. We can then easily configure your automation visually – like this:

There can be some situations where we need to use formulas, but configuration remains straightforward. Here is an example of slightly more advanced logic. Here, our customer wanted a different behavior depending on whether commissions were calculated for the first half vs. second half of the month. Don’t worry if this formula doesn’t make sense. This is only to give you a feel for the type of logic we configure for our clients.

Where things start breaking down is when a client wants us to automate commissions for 8 payees with 5 different roles (ex: AE, VP, SDR, etc.) and 4 commission components per role (ex: monthly commissions, quarterly bonus, Joe’s unique incentives, etc.). If you do the math, this means configuring 20 plans for 8 payees. Worse, some small organizations also include dozens of additional one-off commission rules (some simple and some complex).

While configuring all this logic is very much doable, we feel this is quite unreasonable for a small organization, and gracefully bow out. Indeed, even if we were to automate all those rules, some inescapable complexity would remain. For example, even though calculations are fully automated, you should still audit them. You will also need to refresh metrics (ex: quotas) from time to time. And a fragmented commission structure will likely evolve, generating more complexity for a small team of payees.

In other words, the complexity of a commission structure should be commensurate with the number of payees. If the total number of commission components is more than twice the number of roles, something is probably wrong. Also, if there are 7 payees for 5 roles, it’s time to rethink your commission structure and simplify. You don’t want the cost of managing commissions to exceed commission payouts – right?

Commission Rules Incompatible With Automation

Sometimes, potential clients ask us to automate commission rules such as:

Subject to manager and VP approval, commission rates will be increased by another 20% for strategic deal which result in upsell opportunities

If an AE deal originated from a BDM, the AE’s commission will be split with the BDM based on their mutual contributions

Unfortunately, when we see this type of vague language, we know it’s time to gracefully bow out. Why? Because those types of fuzzy rules cannot be automated. In the first example, managers and VPs have to make manual decisions whether a deal qualifies for extra commissions. The only way to automate this would be to configure a workflow process asking managers to review and approve deals. But, what if the manager is on vacation? Now, we also need an escalation process. Maybe a VP override mechanism. This opens a whole can of worms.

Also, whether a deal will result in “upsell opportunities” is subjective, and not something we can automate. Sure, if you’re willing to customize your CRM and add more data tracking fields (such as one tracking if extra commissions are approved), we can add simple commission logic (example below). Otherwise, automation is NOT going to solve your commission headaches because you will still need your managers to make a lot of manual decisions, constantly override amounts, constantly make adjustments, etc.

The same applies to the “split” commission example above. We understand you are trying to be fair by splitting commissions, but you are also splitting hairs. Here the same rationale applies. If you can provide a tracking data field with each person’s contribution as a percentage, we’ll happily configure split commission rules. Otherwise, you’ll constantly have to make manual decisions and specify overrides within the application, which completely defeats the goal of automating commissions.

In Conclusion

When potential clients reach out and ask us to automate commissions, we try to assess if they are a good candidate for automation. We ask ourselves:

- Is their commission complexity commensurate with the number of payees? If not, automation is not going to help because some unreasonable “inescapable complexity” will remain after deploying automation. Calculations still have to be audited. Payouts still have to be released. Quotas still have to be refreshed. Etc.

- Are commission rules compatible with automation? If payouts are based on manual decisions, automation will fail to deliver because manual intervention will be required all the time. Rules which mention special approvals or conditional splits often cannot be automated because they are not backed by tracking data.

Visit us online to learn more about automating your sales commissions!