Let’s face it – claw backs can be quite messy to deal with. Even the most diligent Sales Ops employee can make mistakes when processing claw backs. In this blog post, we describe solutions to handle even the most painful chargebacks, and make the claw back process more systematic.

What’s A Claw Back?

At times, you may encounter situations where payment cannot be collected from customers, a project was cancelled, or a refund was issued. Therefore, you want your reps to recoup commissions previously paid on those deals. This is commonly referred to as a claw back or a chargeback. This article describes different ways to handle claw backs, including some advantages and disadvantages of each approach.

Option 1 – Record Negative Transactions

To simplify claw backs, you can create new transactions whose amounts are negative. Essentially, negative transactions become a mirror image of positive transactions you already paid commissions on. Using those negative transactions, you can calculate new negative commissions, the exact same way you would calculate positive commissions. This approach is quite convenient as:

- Your claw backs become easy to automate

- You can use the exact same payout rules as for regular commissions

- You can easily handle partial or pro-rated refunds

- Just enter a partial negative amount

- You can leave the original transaction “alone”

- No need to edit the transaction and mark it as cancelled

- Your negative amounts can be used to penalize rep attainment

- Refunds can now impact quota attainment

- You are treating refunds and claw backs the same way

- This keeps handling of all forms of cancellations consistent

- Your revenue reporting and revenue totals makes sense

- You are recording balanced positive and negative amounts

- You have the complete history of events

- You are tracking refunds as a separate event

Is this approach perfect? The answer is no. There are scenarios where newly calculated negative commissions may not 100% offset previously paid ones. For example, let’s say that Joe qualified for a 10% commission in January (based on his attainment), over a $2000 sale. Now, in February, you record a minus $2000 sale (a refund). Unfortunately, Joe’s attainment is lower in February, so his commission rate is 8%. The negative commission will be 8% of minus $2000 – but you paid 10% of $2000 previously! As you can see, because we are calculating a new negative commission, but the situation could have changed, the amount may not match exactly.

Option 2 – Configure Claw Back Logic

If it’s important to accurately claw back the original amount paid in commissions (instead of re-calculating it), you need something else. In this case, you would probably update the original transaction to indicate that a cancellation took place. For example, you may change its status from “Closed Won” to “Cancelled”. You may also set its amount to zero. Finally, you may also update the transaction’s date to the cancellation date.

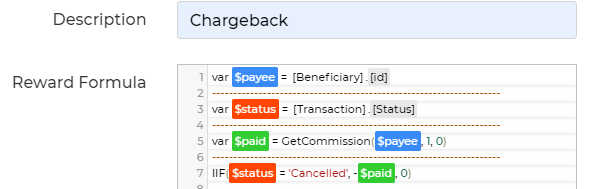

We can now configure a payout formula to a/ detect that the current status is cancelled and b/ recoup the original amount paid in commissions. The formula below uses a magic function called GetCommission(). Using an SPM solution such as Sales Cookie, there is a “memory” (database) of every commission paid on each transaction. This function is able to automatically pull the relevant commission amount.

The example below is quite basic. It just looks up and reverses the original commission amount. In practice, we could use more sophisticated logic, and calculate a pro-rated chargeback amount. The key takeaway here is that we’re using the exact commission amount paid on this sale (instead of calculating a new amount) and using this fact to effect the claw back. This approach isolates your calculation from changing conditions (such as a new quota attainment, updated tiers, updated rates, etc.).

Option 3 – Leverage A Claw Back Tool

There may be situations where:

- You have a list of transactions to claw back commissions from

- You want to claw back the exact amounts previously paid in commissions

- You don’t want to configure a claw back rule because claw backs are infrequent

For this, you can use an automated tool such as the one below.

Using this type of tool, you can enter a list of transactions. The tool will find who received a commission over those transactions, and reverse each amount. You can also provide an explanation to your payees, who will then see it on their dashboard.

In Conclusion

On the surface, claw backs appear simple, but can be a real headache to deal with. In this blog post, we described multiple way to streamline claw backs. Each approach comes with certain advantages and disadvantages. The negative transaction approach makes it easy to implement claw backs and allows for negative attainment. On the flip side, there are situations where reversed amounts may not match original amounts paid. This approximation is sufficient in most cases, but becomes problematic when dealing with large transactions. For scenarios where the exact commission amount should be reversed, using formulas or a claw back tool are great options. Visit us online to learn more about automating your commissions!