Your Sales Ops or Accounting team already knows this – commissions get complicated fast as you layer more rules and exceptions. Many Sales Ops teams spend countless hours carefully calculating commissions. In this blog post, we’ll describe 9 scenarios which make commissions more challenging to deal with and to calculate correctly. Automating your sales commissions will alleviate a lot of this pain. Visit us online to learn how great commission software can empower both your Sales Ops team and your reps.

Splits

Any time you have split commissions, the inevitable question is – how to split? Should the split be applied to both credits and payouts, or just one of those? If you always split evenly, then splits are pretty easy to deal with. Otherwise, clear rules are needed, so that splits can be dealt with in a systematic manner. After all, you don’t want to ask your VP “what are the split percentages for each rep” each time there is a split, right? One thing we love is SalesForce’s built-in opportunity split feature. Using this feature, split percentage are always recorded within SalesForce. This makes it easy to configure formulas which automate splits. For other cases, Sales Cookie includes several common built-in split options, as well as the ability to define more complex formulas.

Claw Backs

Many organizations use claw backs to recoup previously paid commissions (ex: following a refund, return, or cancellation). One easy strategy to deal with claw backs is to input another negative deal, which will then pay a negative commission. This works pretty well if your commission structure doesn’t change. However, there are some situations where this simple strategy doesn’t quite work. For example, if commission rates (or your entire commission structure) has changed, you may need to claw back the exact original commission amount paid months ago. For those cases, you definitely need a system with the ability to a/ automatically lookup and b/ claw back original commission amounts. Otherwise, you’d need to locate old spreadsheets and find who got paid what on each deal!

Catch-up / Retroactive Commissions

Many organizations use commission structures with retroactive payouts. Payouts are only triggered (retroactively) once certain conditions are met. For example, reps may not receive commissions on their January and February closed deals until they hit their quarterly quota. Once their quarterly quota is hit (ex: mid-March), payouts are applied retroactively to all January and February deals. A similar scenario occurs if a single deal’s characteristics can change over time, impacting the amount owed in commissions. For example, let’s say you have a deal worth $100, for which a 10% commission has already been paid. If, later, the same deal’s revenue is updated from $100 to $150, you may need to pay a commission “delta” amount. This is very painful to deal with manually. However, using software, we can re-evaluate the amount owed, lookup previously paid commissions, and only pay the delta.

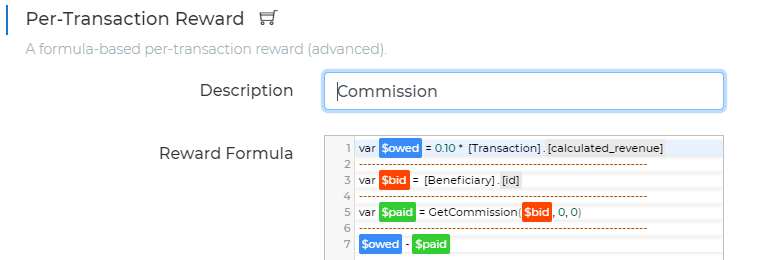

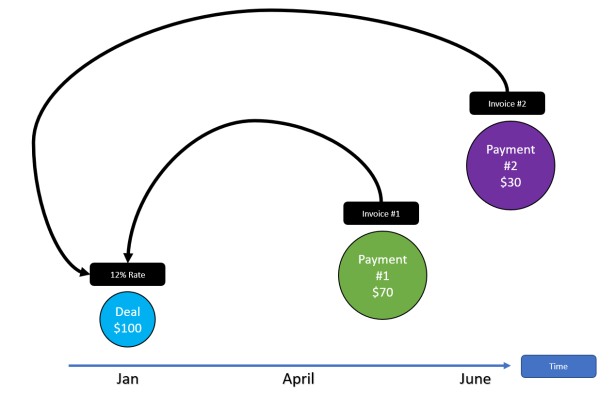

Multiple Data Sets

Sometimes, it’s necessary to use two distinct data sets to calculate commissions. For example, suppose that attainment is based on closed won CRM opportunities, but that commissions are only issued when payments are received from customers. Now, we must deal with two data sources (ex: SalesForce opportunities + QuickBooks invoices) to calculate commissions correctly. This is known as the “pay only when you get paid” model. Here too, calculating commissions manually can be tedious and error-prone. Indeed, each time a payment is received, you must figure out a/ which opportunity this payment was for, b/ who earned a commission on this opportunity, and c/ what the commission rate was (based on attainment). Automation can solve this complex problem for you. Make sure to choose an SPM solution which supports multiple data sources and data cross-lookups.

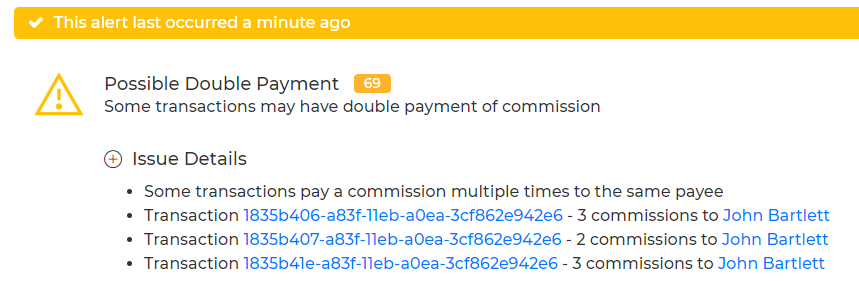

Inaccurate Data

Garbage in, garbage out! Mathematically, the accuracy of your commission calculations cannot exceed the accuracy of your sales data. For example, if your commission structure is based on rep attainment, and someone enters a closed won deal worth $9,999,999, then this rep will incorrectly retire quotas and earn higher rates. Here at Sales Cookie, we’ve built a lot of defensive features to detect problems such as abnormally high amounts, double-payment of commissions, incoherent exchange rates, missing quotas, duplicate calculations, typos in rep names, suspicious team hierarchies, etc. However, all we can do is alert you. We cannot fix sales data for you. Some recommendations we keep daily to our customers include:

- Always use a system to track sales (ex: not a custom spreadsheet)

- Record when things changed (ex: track when an opportunity moved to closed won)

- Think about sales data as an “event log” (ex: prefer adding new records to updating the same record)

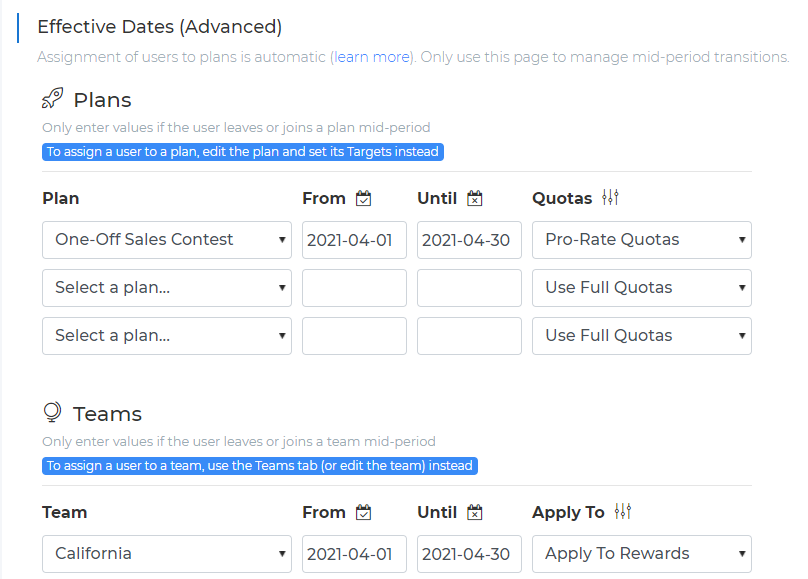

Time-Based Variability

In the world of sales commissions, time is a key aspect because ultimately everything will change – rep quotas, commission rates, payout structures, territories, payee roles, named accounts, etc. Think about your ability to audit past commission calculations. You need to know what the commission “facts” were at any point of time. Unless you implement some careful tracking (or use an SPM solution), this is very difficult. Our general approach at Sales Cookie is to make time-tracking a primary dimension. For example, custom variables you set on users or plans always include effective start and end dates. Similarly, plans have versions, teams members have effective dates, configuration changes are logged, etc.

Multi-Dimensional Hierarchies

If you’re lucky, you only require a single team structure, such as the one below. This is the only hierarchy you need to calculate commissions (ex: crediting rollups, manager overrides, etc.). In reality, however, many organizations require multiple hierarchies. For example, one hierarchy may be based on geography, and another hierarchy may be based on customer verticals, and another based on user permissions. Dealing with multiple hierarchies (in addition to the time dimension!) is no easy task. At Sales Cookie, we’ve developed approaches to automate such scenarios by keeping crediting logic highly flexible.

Exceptions

Perhaps your commission structure includes “fuzzy” payout rules, such as conditional approval by VPs “in some specific cases“, or discretionary splits based on “mutual rep contributions“. Those types of statements absolutely get in the way of automating your commissions, because they require constant manual intervention. Commission rules cannot be configured because, by definition, a human has to make a decision. Formulas won’t help, unless you record those decisions within your data (ex: using custom fields). For all other cases, you need a way to easily make and record adjustments. Sales Cookie provides 6 different ways to adjust commissions. Plus power tools to bulk-process adjustments, process claw backs, manual overrides, etc.

Global Reporting

If you are not using an automated solution, you are probably generating many individual commission spreadsheets. This is a major headache because you must constantly generate, revise, archive, and distribute those spreadsheets. But the difficulty does not stop there. The bigger issue is that your managers do not have visibility on overall sales performance. The only thing they can do is locate commission spreadsheets (for various periods and individuals), and manually put it all together. There is no central system holding all commission data they can query or analyze. For this reason, using an SPM solution with open data APIs is a must. Using Sales Cookie, you can retrieve ALL your data using Excel, Tableau, Power BI, and many other solutions. This includes users, plans, calculations, commissions, rates, quotas, etc.

In Conclusion

We hope this blog post will result in more empathy towards your Sales Ops team. Without a system, calculating commissions manually can be a real headache consuming many hours of painful work. If you haven’t yet automated your commissions, it’s not too late. Visit us online to learn more – we’d love to help.